Contents

A Forex trade has four main components – the asset, the size of the trade, the price, and the direction . Each of these is unique and affects the profitability of the trade. Make sure that your chosen Forex broker offers negative balance protection.

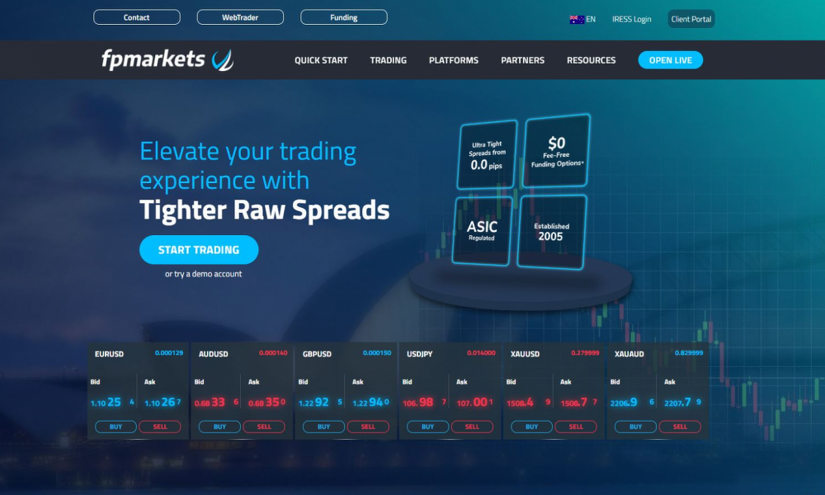

The spread is typically different for each currency pair and is influenced by factors like the pair’s liquidity, the broker’s mark-up and the broker type. Some brokers offer very tight spreads, often based on the raw interbank rate, and in these cases you will pay commission on every trade. For instance, if you are trading a currency pair like the EUR/USD, you will be aware of the interest rate differential between the US and the Eurozone. Also, you should also follow market news that might affect the future performance of your chosen currency pair. But eventually, most traders analyze currency pairs using a candlestick chart and technical analysis indicators. To trade Forex is to essentially buy and sell currencies – with the aim of making a profit.

78% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. As companies continue to expand into markets around the world, the need to complete transactions in the other currencies will continue to increase.

Can You Get Rich by Trading Forex?

Currency trading pre-dates the stock market by hundreds of years and goes back to ancient times. Forex trading involves the practice of exchanging currencies on the international pennant trading strategy market for purposes of hedging or speculation. IQ option is a trading platform where you can trade Forex, Crypto, Stocks, Commodities, Indices and ETFs.

Imagine what that could do to the bottom line if, like in the example above, simply exchanging one currency for another costs you more depending on when you do it? In both cases, you—as a traveler or a business owner—may want to hold your money until the forex exchange rate is more favorable. Currency speculation is considered a highly suspect activity in many countries.[where? For example, in 1992, currency speculation forced Sweden’s central bank, the Riksbank, to raise interest rates for a few days to 500% per annum, and later to devalue the krona. Mahathir Mohamad, one of the former Prime Ministers of Malaysia, is one well-known proponent of this view. He blamed the devaluation of the Malaysian ringgit in 1997 on George Soros and other speculators.

This is the world’s most traded currency pair, and typically has the tightest spreads. Start trading forex – one of the world’s most traded financial markets – today with this step-by-step guide. Starting with how currency trading works, plus how to open your first position. And we finished by discussing whether you can potentially benefit by trading Forex and outlining the things you need to look for when choosing the best platform and best broker for your trading needs. Whatever your starting balance, tixee accounts aim to grow as your needs as a trader grow. For novice traders, we offer a free demo account that you can use to empower your trading skills in a risk-free environment.

How do currency markets work?

We’re committed to ensuring our clients have the best education, tools, platforms, and accounts to navigate this market and trade forex. For beginner traders, it is a good idea to set up a micro forex trading account with low capital requirements. Such accounts have variable trading limits and allow brokers to limit their trades to amounts as low as 1,000 units of a currency. For context, a standard account lot is equal to 100,000 currency units. A micro forex account will help you become more comfortable with forex trading and determine your trading style. Leverage is a facility given by the broker to enable traders to hold trading positions that are larger than what their own capital would otherwise allow.

An open trade is a trade in which a trader has bought or sold a particular currency pair and has not yet sold or bought back the equivalent amount to close the position. For example, in Europe the currency in circulation is called the Euro and in the United States the currency in circulation is called the US Dollar . An example of a forex trade is to buy the Euro while simultaneously selling US Dollar. Some popular entry-level jobs to become a forex trader include forex market analyst and currency researchers. Although getting started on forex is relatively easy, it’s important to know the pros and cons of forex trading. From the comfort of your home, you can learn almost anything as long as you have the desire, and a device connected to the internet.

How long does it take to learn forex?

With some hard work and dedication, it should take you 12 months to learn how to trade Forex / trade other markets – it's no coincidence our mentoring program lasts 12 months! You will always be learning with the trading and must always be ready to adapt and change, but that's part of the thrill and challenge.

The largest quoted currencies – like EUR/USD and USD/JPY – are floating. But if you are wrong, you will have to book high losses in the future. Trading with foreign exchange may be promising, but only if one estimates the development correctly. The risk that one takes here should not be underestimated in any case. Information provided on Forbes Advisor is for educational purposes only. Your financial situation is unique and the products and services we review may not be right for your circumstances.

Disadvantages of Forex Trading

Currency prices are constantly fluctuating, but at very small amounts, which means traders need to execute large trades to make money. Instead of executing a trade now, forex traders can also enter into a binding contract with another trader and lock in an exchange rate for an agreed upon amount of currency on a future date. In forex trading, the difference between the buying price and selling price of a currency pair is called the spread. The aim of forex trading is to exchange one currency for another in the expectation that the price will change in your favour. Currencies are traded in pairs so if you think the pair is going higher, you could go long and profit from a rising market. However, it is vital to remember that trading is risky, and you should never invest more capital than you can afford to lose.

You can use numerous trading strategies to inform your trading decisions. Forex trading strategies, like other trading strategies, can be based on a combination of technical analysis and fundamental analysis. Technical and fundamental analysis are very different, so a blend of the two can be used to develop a more balanced trading strategy. Because you are buying one currency, while selling another at the same time you can speculate on up and down movements in the market. It is a bit of a stretch to get your head around if you’re coming across spread for the first time but this is one of the ways traders pay the market to trade – its a cost of trading.

Do Espírito Santo de Silva (Banco Espírito Santo) applied for and was given permission to engage in a foreign exchange trading business. To avoid having to tie up all their capital when opening one position, most forex traders use leverage. With leverage, you only have to put up a fraction of your position’s full value to open a trade. The essential goal of forex trading is to buy low and sell high, making a profit on your initial investment. Understanding the basics of going long or short in forex trade is fundamental for all beginner traders.

Pros and Cons of Forex Trading

Some of them may just choose to focus on investment funds, some just focus on commercials company or maybe some can have dealings with all three different categories. If I’m the car maker, in order to buy the raw materials to manufacture my car, I need to get them in a foreign country. Banks like Deutsche Bank, Goldman Sachs, HSBC where they trade Forex, but as a form of market making to provide liquidity to corporations. This is an example of the Central Bank intervening in the FX markets. In order to get Malaysian ringgit, I need to sell my Singapore dollars for Malaysian ringgit.

How do beginners trade?

- Set Aside Funds. Assess and commit to the amount of capital you're willing to risk on each trade.

- Set Aside Time. Day trading requires your time and attention.

- Start Small.

- Avoid Penny Stocks.

- Time Those Trades.

- Cut Losses With Limit Orders.

- Be Realistic About Profits.

- Stick to the Plan.

This is where there is a physical exchange of the currency pair that occurs when the trade is settled. It is mostly banks and large institutions that take part in the spot market, but brokers like AvaTrade offer derivatives based on the spot forex markets. Next is the forward forex market, which is where there are private agreements to buy or sell DowMarkets Broker a certain amount of currency at a certain time or times. And then there is the futures forex market, which is similar to the forward forex market, except in the futures market the contracts can be traded on futures exchanges. The trading of the seven major forex pairs makes up 8 out of every 10 forex trades placed on foreign exchange markets.

Similarly, traders can opt for a standardized contract to buy or sell a predetermined amount of a currency at a specific exchange rate at a date in the future. This is done on an exchange rather than privately, like the forwards market. Forex trading or foreign exchange trading, has become the biggest financial market in the world with over USD $3 trillion traded each day in the UK alone. Like with any type of trading, financial market trading involves buying and selling an asset in order to make a profit.

Forex vs CFDs: Differences & Similarities

Your broker will “lend” you a certain percentage of a given position’s value, with your own funds being used as a deposit – this deposit is called margin. If you’re planning to make a big purchase of an imported item, or you’re planning to travel outside the U.S., it’s good to keep an eye on the exchange rates that are set by the forex market. A forex trader might buy U.S. dollars , for example, if she believes the dollar will strengthen in value and therefore be able to buy more euros in the future. Meanwhile, an American company with European operations could use the forex market as a hedge in the event the euro weakens, meaning the value of their income earned there falls.

Businesses that purchase raw materials or goods from overseas and need to exchange their local currency to the currency of the country of the seller. Our mission is to keep pace with global market demands and approach our clients’ investment goals with an open mind. XM sets high standards to its services beginners guide to technical analysis because quality is just as decisive for us as for our clients. We believe that versatile financial services require versatility in thinking and a unified policy of business principles. Plotted on a chart, the different rates for different forward dates represent what’s called the forward curve.

What do I need to know before I start forex?

- The currency pairs you are trading in. It's important to be familiar with the currency pairs you're trading in.

- The significance of the bid-ask spread.

- Leverage.

- Forex trading strategies.

- Your trading plan.

- Your emotions and biases.

If you are going to spend a lot of time trading a single currency pair, learn what moves that currency pair’s price and when these price changes happen. Technical analysis, on the other hand, is a trading discipline that helps investors to predict price movement by using the past performance of the asset and technical indicators on a trading chart. Forex market is short for ‘foreign exchange market’ and is the most liquid and largest market in the world with an average daily trading volume exceeding $6 trillion. When trading currencies, trade only when you expect the currency you are buying to increase in value relative to the currency you are selling. If the currency you are buying does increase in value, you must sell back the other currency in order to lock in a profit.

Forex Trading working Hours

To ensure that you have your best chance at forex success, it is imperative that your on-the-job training never stops. Developing solid trading habits, attending expert webinars and continuing your market education are a few ways to remain competitive in the fast-paced forex environment. Trade your opinion of the world’s largest markets with low spreads and enhanced execution. Futures are standardized forward contracts and are usually traded on an exchange created for this purpose.

To make profitable trades, forex traders need to be comfortable with massive amounts of data and rely on a mixture of quantitative and qualitative analysis to predict currency price movements. Bank of America Merrill Lynch4.50 %Unlike a stock market, the foreign exchange market is divided into levels of access. At the top is the interbank foreign exchange market, which is made up of the largest commercial banks and securities dealers. Within the interbank market, spreads, which are the difference between the bid and ask prices, are razor sharp and not known to players outside the inner circle. The difference between the bid and ask prices widens (for example from 0 to 1 pip to 1–2 pips for currencies such as the EUR) as you go down the levels of access.

You can trade derivatives on forex from home using short, medium or long-term strategies on a wide range of currency pairs that we offer. The 2016 Triennial Central Bank Survey from the Bank For International Settlements shows that the USD is the dominant currency, as “it was on one side of 88% of all trades in April 2013 to April 2016″. When trading Forex, you’re trading currency pairs – what this means is you are buying one currency and selling the other so the price you see is the price of one currency relative to the other. This leverage is great if a trader makes a winning bet because it can magnify profits. However, it can also magnify losses, even exceeding the initial amount borrowed.

These companies differ from Money Transfer/Remittance Companies in that they generally offer higher-value services. Around 25% of currency transfers/payments in India are made via non-bank Foreign Exchange Companies. Most of these companies use the USP of better exchange rates than the banks. They are regulated by FEDAI and any transaction in foreign Exchange is governed by the Foreign Exchange Management Act, 1999 . National central banks play an important role in the foreign exchange markets.

Follow the 1% rule for how much money you risk and use stop losses to manage risk on individual trades. Also keep an eye on your win rate as well as the risk/reward ratio and adjust your strategy accordingly. In forex trading, a «percentage in point,» or «pip,» is how traders refer to the movement of the currency pairing being traded. It’s a small movement, and it may be the smallest measurable movement, although some brokerages may measure partial pip movements. Pip size varies, depending on the pairing being traded, so learning the pip size must be part of your research when trading a new product. Pips aren’t used in stocks, because all stock price movements are measured in dollars and cents.